Understanding Forex Trading: A Comprehensive Guide

Forex trading, or foreign exchange trading, is the process of buying and selling currencies in the global market. It is one of the most actively traded markets in the world, with trillions of dollars exchanged daily. For those interested in entering this high-stakes arena, understanding the intricacies of Forex trading is crucial. This guide aims to provide an in-depth look at what Forex trading entails, its mechanisms, the strategies traders employ, and the tools available to enhance trading success. You can start your journey by visiting what is trading forex fx-trading-uz.com.

What is Forex Trading?

At its core, Forex trading involves the exchange of one currency for another. Unlike other markets that trade physical assets, Forex operates on a decentralized platform, meaning that trades take place over-the-counter (OTC) rather than through a central exchange. This allows for greater flexibility and accessibility, enabling traders from around the globe to participate.

The Structure of the Forex Market

The Forex market consists of multiple players, including banks, financial institutions, corporations, individual traders, and even governments. Major financial centers such as London, New York, Tokyo, and Sydney play critical roles in the liquidity and accessibility of the market. Trades can occur 24 hours a day, five days a week, allowing traders to engage in transactions at any time.

Currency Pairs in Forex Trading

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar), which reflects how much of the quoted currency (USD) is needed to purchase one unit of the base currency (EUR). The first currency in the pair is known as the base currency, while the second is the quote currency. Understanding how to read these pairs is essential for successful trading.

Types of Currency Pairs

Currency pairs are categorized into three main types:

- Major Pairs: These are the most commonly traded pairs and usually include the USD, such asEUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: These pairs do not involve the USD, like EUR/GBP or AUD/NZD. They tend to have lower liquidity than major pairs.

- Exotic Pairs: These involve one major currency and one currency from an emerging or smaller economy, e.g., USD/THB (US Dollar/Thai Baht).

How Forex Trading Works

Forex trading operates on the principle of speculation, with traders attempting to predict currency movements to profit from price changes. Here’s a simplified breakdown of how it works:

- Choosing a Broker: Traders need to find a reliable Forex broker who will provide access to the market, offer trading platforms, and facilitate transactions.

- Opening an Account: After selecting a broker, the next step is to open a trading account. This may involve providing personal information and verifying identity.

- Funding the Account: Traders must deposit funds into their account to start trading. Many brokers offer various payment methods for flexibility.

- Execution of Trades: Using charts and analysis tools, traders decide when to buy or sell currency pairs, placing orders through their broker’s platform.

- Monitoring the Market: Successful traders continuously analyze market trends and news to make informed trading decisions.

Trading Strategies

There are numerous strategies traders employ to maximize their chances of success in Forex trading. Some popular methods include:

- Day Trading: Involves making multiple trades throughout the day, aiming to profit from short-term price fluctuations.

- Swing Trading: Traders hold positions for several days or weeks, taking advantage of medium-term market moves.

- Scalping: A strategy that focuses on making small profits from numerous trades within short time frames.

- Position Trading: Involves holding trades for longer periods based on fundamental analysis of economic indicators.

Tools and Resources for Forex Trading

To successfully navigate the Forex market, traders use a variety of tools and resources, including:

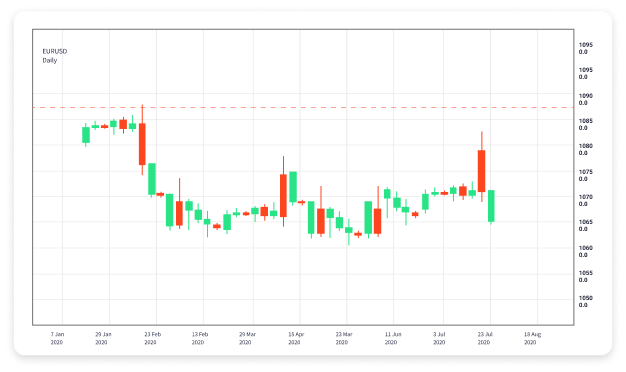

- Charting Software: Tools that provide visual representations of price movements, helping traders identify patterns and trends.

- Forex Signals: Services that provide buy or sell alerts based on market analysis, helping traders make informed decisions.

- Economic Calendars: These track important economic events and indicators that may affect currency values.

- Market News and Analysis: Staying updated with the latest news in the financial world is crucial for understanding market movements.

Risks Associated with Forex Trading

While Forex trading offers substantial opportunities, it also comes with risks. Market volatility can lead to significant losses, and leveraging (borrowed funds) can amplify both gains and losses. Traders must manage their risks effectively, utilizing techniques such as setting stop losses and diversifying their portfolios.

Conclusion

Forex trading is a dynamic and multifaceted market that requires both skill and knowledge. Understanding the mechanisms of currency trading, recognizing the importance of market analysis, and employing effective strategies are essential for success. With the right education and tools, anyone can explore the thrilling world of Forex trading.

Further Learning

For those interested in enhancing their Forex trading skills, numerous educational resources are available online, from courses to e-books and forums. Engaging with other traders and continuously learning about the ever-evolving market can significantly increase one’s chances of success in Forex trading.

Leave a Reply